Great Guidance Concerning Residence Mortgages That Anyone Can Easily Follow

Written by-Hart SpiveyWhile everyone considers buying a home at some point in their life, having to get a mortgage to pay for it can seem intimidating. In fact, some people are so worried about the situation that they continue to rent instead. Build your confidence by reading this article and learning about mortgages.

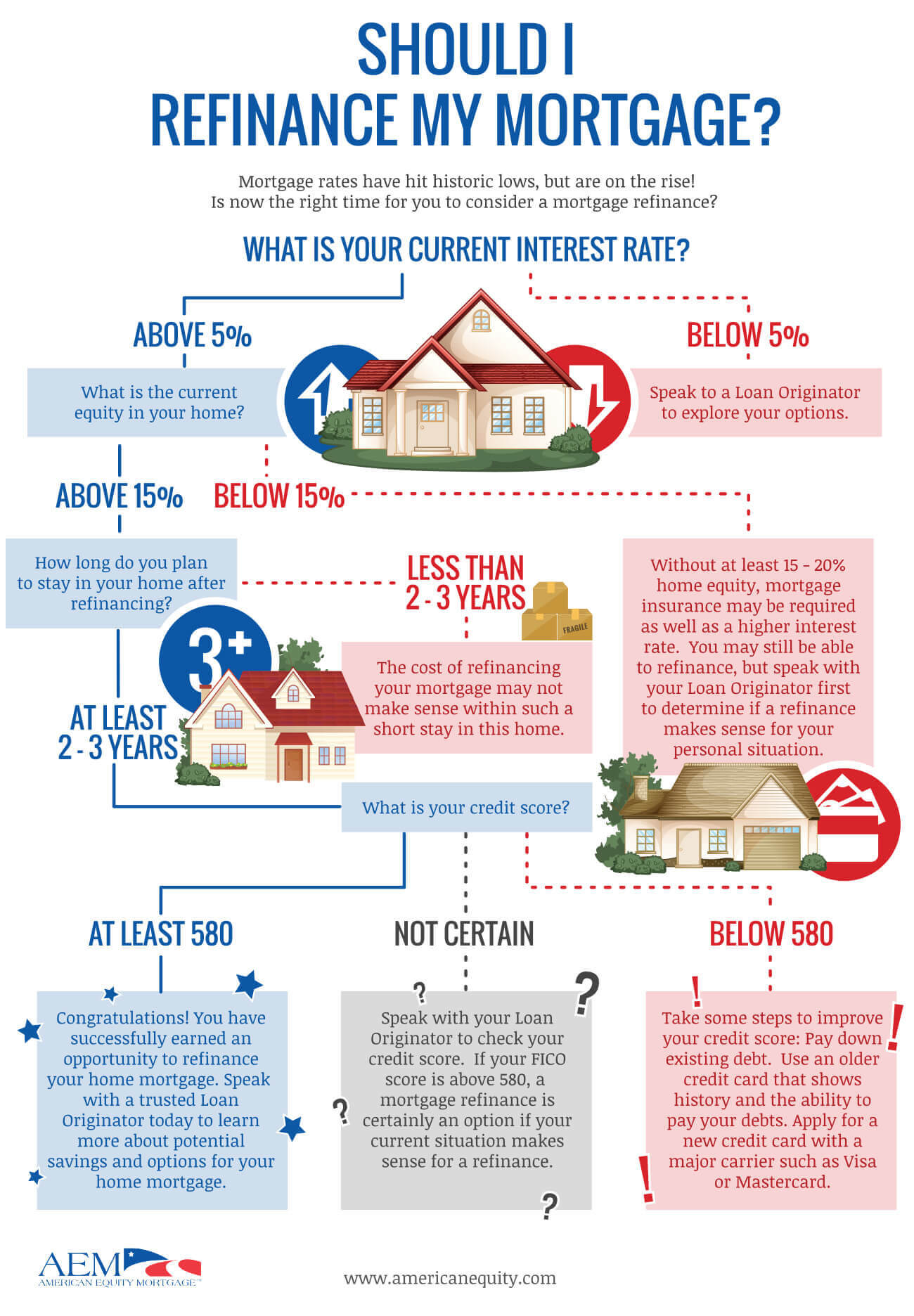

Understand your credit score and how that affects your chances for a mortgage loan. Most lenders require a certain credit level, and if you fall below, you are going to have a tougher time getting a mortgage loan with reasonable rates. A good idea is for you to try to improve your credit before you apply for mortgage loan.

Gather all needed documents for your mortgage application before you begin the process. These documents are the ones most lenders require when you apply for a mortgage. Income tax returns, W2s, bank statements and pay stubs are usually required. If you have the documents in hand, you won't have to return later with them.

Regardless of how much of a loan you're pre-approved for, know how much you can afford to spend on a home. Write out your budget. Include all your known expenses and leave a little extra for unforeseeable expenses that may pop up. Do not buy a more expensive home than you can afford.

Know how much you can afford to put towards your home mortgage. Do not rely on the lender to tell you the amount you qualify for, causing you to borrow the maximum amount. Try planning your budget and leaving some room for unexpected expenses. https://www.bizneworleans.com/hancock-whitney-expands-corporate-commercial-banking-teams/ is usually the case when you buy a home. You can use banking calculators to determine how much you can afford on a home and provide an estimate of the monthly mortgage payments.

Don't forget to calculate closing costs when applying for a mortgage, particularly if this is your first time. Above and beyond the down payment, numerous charges exist simply for processing the loan, and many are caught off guard by this. You should anticipate paying up to four percent of the mortgage value in total closing costs.

Keep in mind that not all mortgage lending companies have the same rules for approving mortgages and don't be discouraged if you are turned down by the first one you try. Ask for an explanation of why you were denied the mortgage and fix the problem if you can. It may also be that you just need to find a different mortgage company.

Look into no closing cost options. If closing costs are concerning you, there are many offers out there where those costs are taken care of by the lender. The lender then charges you slightly more in your interest rate to make up for the difference. This can help you if immediate cash is an issue.

Mortgage rates change frequently, so familiarize yourself with the current rates. You will also want to know what the mortgage rates have been in the recent past. If mortgage rates are rising, you may want to get a loan now rather than later. If the rates are falling, you may decide to wait another month or so before getting your loan.

Choose https://www.businessinsider.com/personal-finance/chase-vs-bank-of-america lender many months in advance to your actual home buy. Buying a home is a stressful thing. There are a lot of moving pieces. If you already know who your mortgage lender will be, that's one less thing to worry about once you've found the home of your dreams.

You can request for the seller to pay for certain closing costs. For example, a seller can pay either a percentage of the closing cost or for certain services. Many times the seller is responsible for paying for a termite inspection along with a survey and appraisal of the property.

Make sure you pay down any debts and avoid new ones while in the process of getting approved for a mortgage loan. Before a lender approves you for a mortgage, they evaluate your debt to income ratio. If your debt ratio is too high, the lender can offer you a lower mortgage or deny you a loan.

After getting a home loan, try paying a little extra on the principal each month. This will help you pay off your loan much faster. For instance, if you pay a hundred dollars more toward your principal, you can reduce your loan term by ten years or more.

Know the real estate agency or home builder you are dealing with. It is common for builders and agencies to have their own in-house financiers. Ask the about their lenders. Find out their available loan terms. This could open a new avenue of financing up for your new home mortgage.

If you are a first time home owner, get the shortest term fixed mortgage possible. The rates are typically lower for 10 and 15 year mortgages, and you will build equity in your home sooner. If you need to sell you home and purchase a larger one, you will have more cash to work with.

Make sure that you fully understand the process of a mortgage. You need to stay informed throughout the process. Give all contact information to your broker. Keep up with emails and other messages from the brokerage firm, in case they need to update your files with additional information.

Be careful in making large, untraceable deposits to your savings account. Due to the Anti-Money Laundering Act, the bank may ask questions about the money. This means your loan may be denied and you may be reported to the authorities.

Do not do anything that will raise red flags to the lender while you are waiting for approval. Co-signing on a loan for someone else, changing jobs, moving to a new address or applying for a name change are all things that should never be done until after your loan is closed.

Many people are lost when they start down the road of finding the perfect home mortgage. It should not be a complicated process if you are educated in this field. Anyone can be a mortgage expert if they tools and tips to help them along the way. The article you read here has given you great insights to the world of home mortgages.